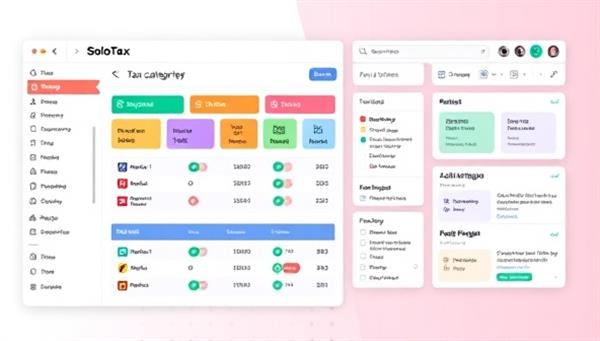

Business Name:SoloTaxPro

Description:Creating a comprehensive freelancer tax compliance toolkit that includes tax calculators, expense tracking tools, deduction guides, and tax filing resources tailored to freelancers, gig workers, and independent contractors. This innovative solution simplifies tax compliance for freelancers and empowers them to manage their taxes efficiently.

Profitability:This idea is profitable as it targets a growing segment of the workforce shifting towards freelance and gig economy roles. The ideal customers are freelancers seeking affordable and user-friendly tax solutions to navigate complex tax obligations.

Required Skills:Knowledge of self-employment tax laws and regulations Experience in tax software development and tool creation Understanding of freelance financial management and tax planning Ability to create user-friendly and intuitive tax resources

Go-To-Market (GTM) Strategy:Collaborate with freelance platforms to promote the tax compliance toolkit to their user base Offer a free tax webinar series for freelancers covering tax tips and best practices Run targeted social media ads and content targeting freelance communities and groups Provide personalized tax consultations as part of premium toolkit packages